Complete Guide to Selling Property in Spain

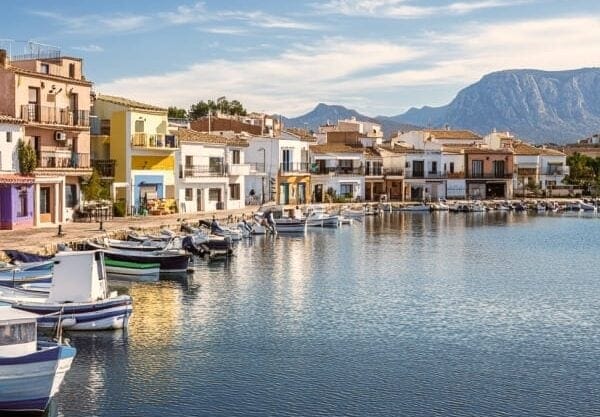

Are you considering selling your property in Spain? Whether you own a sun-drenched villa in Costa Blanca or a modern apartment in Barcelona, understanding the Spanish property market and sales process is crucial for a successful transaction. This complete guide will walk you through everything you need to know about selling property in Spain.

Current Spanish Property Market Overview

The Spanish property market has shown remarkable resilience despite global economic challenges. As of late 2023, while overall home sales experienced a 9% decrease, foreign buyers have noticed a notable increase, particularly in coastal areas like Costa Blanca. Property prices continue to show steady growth, with a 4.5% increase last year, outperforming the eurozone average.

In Costa Blanca specifically, areas like Alicante and Torrevieja have seen particularly strong interest from international buyers. The region’s combination of beautiful Mediterranean coastline, excellent infrastructure, and relatively affordable prices compared to other Spanish coastal areas makes it especially attractive to foreign investors.

Costs to Consider When Selling

- Plusvalía Tax

Calculated based on property value and ownership length. Our team will assist in determining your total costs. - Community Fees

Keep fees updated to present a valid certificate to buyers. - Utilities & IBI

All bills must be settled by the sale date. The seller is responsible for IBI for the year of sale. - Mortgage Settlement

Mortgage cancellation fees, if applicable, must be settled. - Non-Resident Retention

Non-residents are subject to a 3% withholding from the sale price, which can be reclaimed. Additionally, Capital Gains Tax is charged at 19% for EU residents and 24% for non-EU residents.

What are the steps involved in selling property in Spain?

Selling property in Spain involves steps such as preparing the property for sale, setting the right price, hiring a real estate agent, marketing the property, negotiating offers, accepting an offer, completing legal paperwork, and finalizing the sale with the signing of the deed in front of a notary.

How We Can Help

Our team offers personalized support and a free property valuation to get you started. We’re dedicated to helping you sell quickly and profitably.

Essential Documents

- Necessary Documents for Selling Property in Spain

Gather essential documents early to prevent delays and reassure buyers. Consult a legal expert if needed. - Title Deed of the Property

The “escritura de propiedad” confirms ownership. Ensure details are correct and obtain a copy from your notary or Land Registry. - The Role of the Energy Certificate

An EPC rates energy efficiency from A to G. It’s essential for selling or renting and can enhance property appeal. - Proof of Mortgage Cancellation

Provide a bank certificate showing the mortgage is paid off to guarantee a clear title transfer. - Latest Paid Invoices

Ensure utility bills are up to date to prove no outstanding debts and ease the transition for the buyer. - IBI – Yearly Property Tax

Keep IBI payments current and present proof to avoid disputes over unpaid taxes. - Declaration of Habitability

This document verifies the property is livable and is required for legal occupancy and utility transfers. - Documents Relating to the Urbanisation

Provide community-related documents, including rules and fees, to maintain transparency with buyers. - NIE Number

An up-to-date NIE number is required for property sales and tax processing. Obtain it through a consulate or in Spain.

When is the best time to sell your property in Spain?

What factors should you consider when deciding to put your property on the market?

- Seasonal Demand: Spring and early autumn typically see the highest buyer activity, especially in coastal areas like Costa Blanca.

- Local Market Conditions: Currently, new-build properties are showing stronger price growth compared to existing homes.

- Property Type: Different property types have varying demand cycles (e.g., beachfront properties often sell better during peak tourist seasons).

Price Considerations

To determine your optimal asking price of the property:

- Research recent sales of similar properties in your area.

- Consider your property’s unique features (sea views, pool, renovation status).

- Factor in the current market trends in your specific region.

- Consult with local real estate agents for professional valuation and expert advice.

For example, in Costa Blanca, a 3-bedroom villa with a pool and sea views might command a significantly different price in Javea compared to inland areas.

Read more about Spanish property price trends.

Why Seek Help from Property Agents When Selling Your Home

Real estate experts provide valuable insights into market trends, assist in determining the optimal sale price, and handle negotiations with potential buyers.

Additionally, they guide sellers through the intricate legal requirements, ensuring a smooth transaction. With their expertise in property sales, real estate professionals play a pivotal role in maximizing the value of the property and expediting the selling process.

Ready to Sell Your Home in Spain?

Our dedicated team is here to help you every step of the way. Contact us for a personalized consultation.

Get a free valuation or more info—no obligations.

By submitting this form, you confirm that you agree to our website terms of use, our privacy policy and consent to cookies being stored on your computer.

The Step-by-Step Selling Process

1. Property Preparation and Documentation (1-2 weeks)

When selling property in Spain, it is crucial to ensure that you have all necessary legal documents ready by the time of sale. The complete list of needed documents, including the title deed and a simple note from the Land Registry, will be used to verify ownership and any potential encumbrances on the land.

Before listing your property, gather these essential documents:

- The property’s title deeds (Escritura, Land Registry)

- Latest IBI (property tax) receipts

- Energy Performance Certificate (EPC)

- Community fee receipts (if applicable)

- Copies of utility bills from the last year

- NIE number documentation

- Proof of payments for any recent renovations

- An inventory of furniture and other fixtures which will be included in the sale

Pro Tip: Having all documentation ready before listing can significantly speed up the sale process

2. Choosing Your Sales Strategy (1-2 weeks)

Hire the right estate agent

While not mandatory, working with a reputable estate agent can be invaluable, especially in areas popular with international buyers. In Costa Blanca, look for agents who:

- Are licensed real estate agents

- Have experience with international clients

- Maintain a strong online presence and multiple listing partnerships

- Offer comprehensive marketing services

- Provide multilingual services

Expected Costs: Agent commissions typically range from 3-8% of the sale price, with Costa Blanca averaging around 5%.

Selling on your own

- Direct selling through property websites

- Using property auction houses

Tip: This option is recommended only for those who are knowledgeable about the requirements for documents and legal matters in Spain.

3. Marketing Your Property (Ongoing)

Advertising and Marketing Tactics for Selling Property in Spain

To successfully sell property in Spain, it’s important to use smart advertising and marketing strategies. Working with a real estate agent or listing your property on well-known websites can greatly increase its visibility. High-quality photos highlighting the property’s best features and clear and appealing descriptions are essential. Online marketing campaigns and social media promotions can help reach interested buyers.

Effective marketing strategies include:

- Professional photography and virtual tours

- Listings on major Spanish property portals (Idealista, Fotocasa)

- International property website listings

- Social media marketing

- Local newspaper advertisements

Costa Blanca Tip: Emphasize features particularly attractive to international buyers:

- Distance to beaches and golf courses

- Airport proximity

- Year-round sunshine statistics

- Local amenities and expatriate communities

4. Legal Preparation and Support (2-3 weeks)

Legal Documentation Required for Selling Property in Spain

The necessary paperwork includes the title deed (escritura), energy efficiency certificate, and proof of payment of the latest Municipal Property Tax (IBI). Additionally, the last IBI receipt, the Community of Owners certificate, and any outstanding debts related to the property must be in order. Legal representatives may advise on additional documents needed for a smooth transaction.

Appointing Professional Help

- Hire Solicitor (Abogado)

- Handles legal aspects of the sale

- Reviews contracts

- Ensures compliance with local regulations

- Hire Notary (Notario)

- Oversees the official transfer

- Validates documentation

- Registers the sale

5. The Sales Process (6 to 8 weeks)

Initial Offer and Negotiation

When you receive an offer:

- Consider the buyer’s position (cash buyer vs. mortgage)

- Review any conditions attached to the offer

- Negotiate through your agent or solicitor

- Agree on included fixtures and fittings

Contract Phase

- Reservation Contract (Optional)

- Small deposit (typically €3,000-6,000)

- Property removed from market

- Basic terms agreed

- Private Purchase Contract (Contrato Privado de Compraventa)

- A 10% deposit is typically paid

- Completion date set

- Specific terms and conditions detailed

Completion (Escritura) and Sale of the Property

The final stage involves:

- Meeting at the notary’s office

- Signing the public deed

- Receiving final payment

- Transferring utilities

- Handing over keys

Taxes and Fees for Sellers in Spain

Understanding and Managing Taxes and Fees for Sellers in Spain

A number of taxes and fees apply when selling in Spain, which you will need to be aware of. The financial aspect is a vital part of the process in ensuring that everything goes through without any hitches.

Sellers should be aware of capital gains tax implications, notary fees, and any outstanding debts. Understanding the local municipal taxes and necessary documentation is crucial to avoid future legal issues. Additionally, managing the proceeds of the sale through a Spanish bank account is essential for a smooth transaction. Seeking professional advice on tax rates and legal fees can streamline the process and ensure compliance with Spanish tax regulations.

Seller's Costs

Capital Gains Tax (IRPF) Rates vary based on profit:

- Up to €6,000: 19%

- €6,000-€50,000: 21%

- €50,000-€200,000: 23%

- €200,000-€300,000: 27%

- Over €300,000: 28%

Municipal Capital Gains Tax (Plusvalía) Based on:

- Value of the land increase

- Years of ownership

- Local municipal rates

Tax Exemptions and Reductions

You might qualify for exemptions if:

- You’re over 65 and selling your main residence

- Reinvesting in another primary residence

- Purchased the property in specific tax-advantaged periods

How Quickly Can Your Property Sell in Today's Market?

In Spain, the final stages of buying a property, from negotiation to closing the deal at the notary, usually take 1 to 3 months. However, this property sale timeline in Spain can vary.

Factors such as the complexity of the property transaction, how the buyer finances the purchase, and regional legal requirements all play a role. Understanding these can streamline the Spanish real estate selling process.

Based on current market data:

- 20% of properties sell within 7 days

- 15% sell within one month

- 21% take up to three months

- 29% require up to a year

Once a buyer is found, the actual sales process typically takes 1-2 months.

If you’re planning to sell property in Spain, being well-prepared and consulting with experts can greatly increase your chances of closing the deal within your desired timeline.

Need assistance? We're here to help.

Customer Feedback

Maris from the Sunnycasas team was the fantastic agent who helped me find my dream home in Spain. She listened to my needs and presented a great selection of properties. Maris was a joy to work with, very knowledgeable, and facilitated connections with key contacts, like mortgage advisors. I’m very grateful for this excellent experience! Thank you, Maris and Sunnycasas!

Emilija Petrović

From start to finish, the service was extraordinary. The entire Sunnycasas team, including everyone involved, was both professional and friendly. I consider myself fortunate to have chosen the right agents. Simply top-tier!

Giovanni Rossi

I’m from the USA, and without the help of the Sunnycasas team, I have no idea how I would have managed my home search in Spain. From start to finish, they were incredibly supportive in every way, including their excellent customer service. They can also recommend financial firms and attorneys if you need them. I would highly recommend Sunnycasas to anyone looking for assistance in finding a home in Spain.

Jessica Thompson

Properties in Sale

Newest Properties Around You

Duplex Penthouse in Orihuela Costa – Playa Flamenca

169,900€

Added: September 29, 2025